Loans are crucial when you need to invest or if you’re in a slippery financial situation. Lenders are ready to assist dishing out loans while securing advantages. Your mortgages are one of these kinds of transactions with properties on the line. All concerned parties need to have an agreement to fulfill each side of the deal. Plus, these arrangements do come with a variety of fees to pay. Thus, honoring the handshake through respecting financial obligations is the goal to achieve!

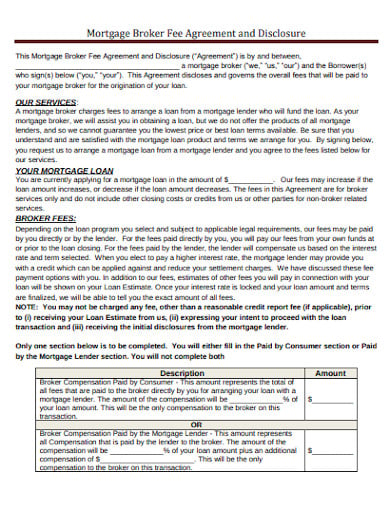

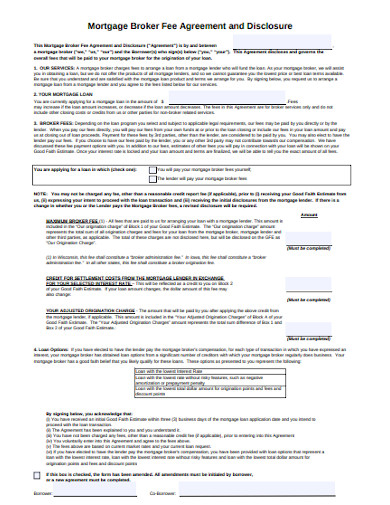

Mortgages are not without fees, and these include the appraisal fees, processing fees, and tax service fees. All of these payments cover the necessary deal inclusions and labor costs behind the transaction, especially coming from the lender. Completing these payments will render a done deal.

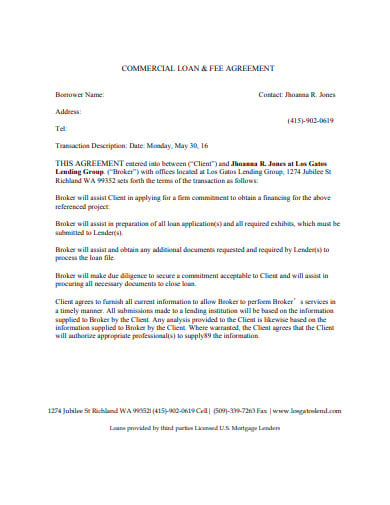

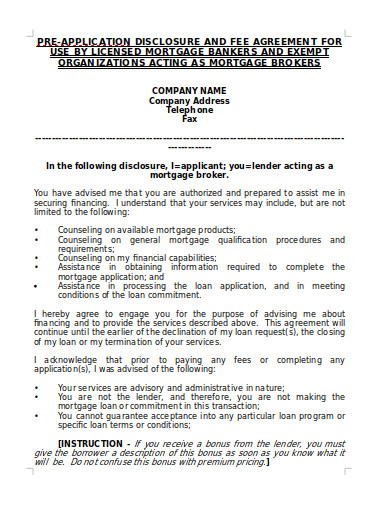

Getting a loan approved is not without costs. Your agents are spending their time to study the mechanics of the trade. Moreover, they are doing most of the processes for your convenience. From document preparation to submission, inevitably, agents are not the only ones doing their tasks. Labor is not free; thus, a fair price is on the wait as the client is finding means to pay them and neatly settling all of these needs mutual understanding from all concerned parties. Avoiding problems is a goal, and that is why the lender and the client need to agree upon the mortgage fees. Similar to a contract document, it needs to be final and executory. So, better allow the room for negotiations for an organized way to pay what is due.

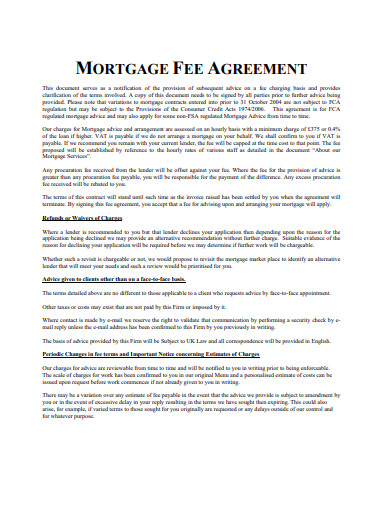

miltonpj.net

File Format

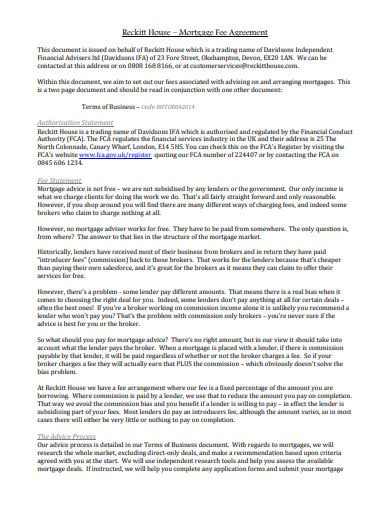

reckitthouse.com

File Format

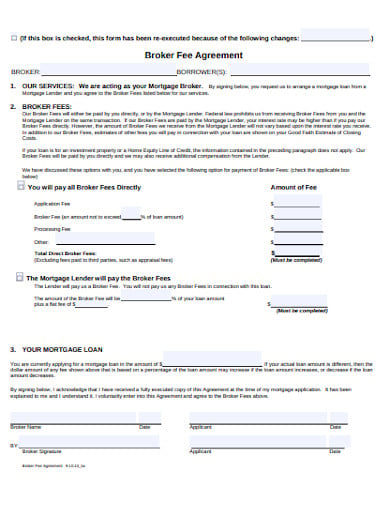

cmgfi.com

File Format

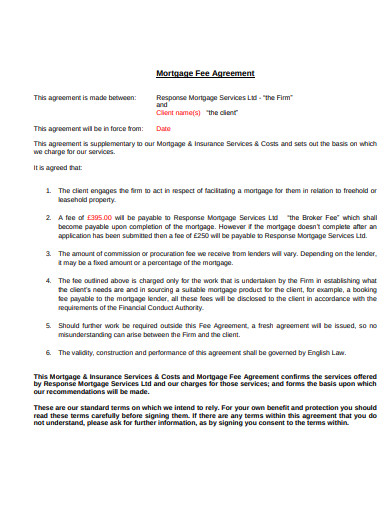

responsemortgages.co.uk

File Format

michiganmutual.com

File Format

mimbroker.com

File Format

optionscommercialmortgage.com

File Format

wiftsureloans.com

File Format

eagleabstract.com

File Format

mortgage-investments.com

File Format

dfs.ny.gov

File Format

sba.gov

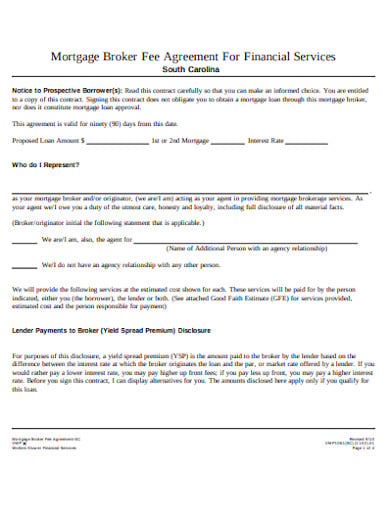

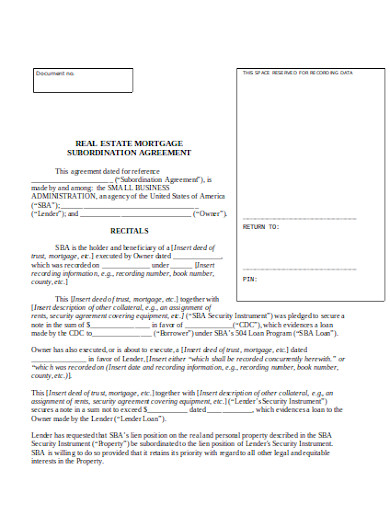

File FormatMortgages are critical loan ventures as properties such as houses are at stake. Lenders offer loans while loan officers step in to do property valuations and to provide an itemized fee worksheet. However, any money lending activity needs trust, especially in fee payment; thus, agreements need to work for all parties concerned. That is why a simple list of steps below will guide you to seal a proper deal.

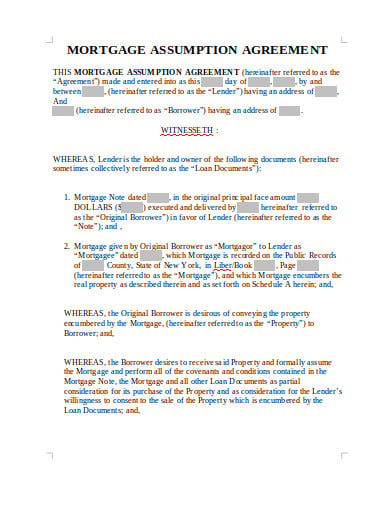

Agreements start first with proposal documents. An interested client expresses the need for a loan; thus, as a loan officer, you can find those requests on the desk. Go over the files and see which catches your attention. Having the application document attached to your agreement in word makes for a complete deal profile.

An approved letter means an upcoming survey of the lot. So, ready your best person to name the price, which is also fitting for the cash needed. Do remember that property value is a crucial piece in the whole process. Thus, estimate sheets are indispensable in this step! Think of your agreement in word with supporting estimation documents.

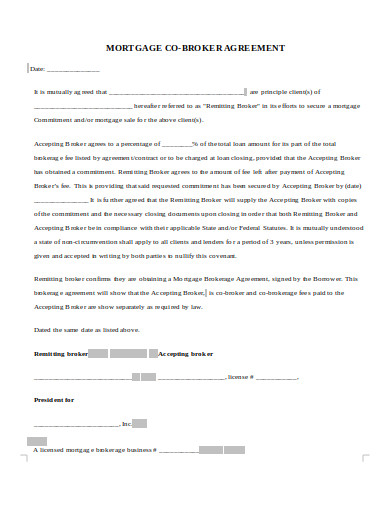

A variety of fees covers the expense of the process. It can include broker’s fees, taxes, and appraisal fees. Do state all charges so that transparency and authenticity are in the deal. Plus, fully closing the transaction means complete fees payment. And you can make it easier to share with your clients for previews by having your agreement in Google Docs.

Raising offers or scratching off confusing details are a staple in the negotiation. Make sure to give the time that both parties understand the provisions and even modify the contents. Also, allowing your clients to have a say for the deals will ensure their active participation. Moreover, they can have suggestions that can even be beneficial for both parties.

A signature and a handshake are meaningful gestures to set the agreement to motion. A sign on the dotted line assures that both parties are in agreement and that each needs to live out their obligations. Moreover, from the legal point of view, the ink mark is one crucial evidence. And do not forget to end it all with a customary yet cordial handshake.

Fees are essential in any transaction as they serve as payments for the costs they cover. That is why you always have to spare the time to divulge the information to your clients and make them as well negotiate for better ways to get things done. Do take note that a done deal is a result of a professional agreement. Thus, a done deal ensures paying what is due.